How to Optimize Charitable Giving to Maximize Tax Savings

The Tuesday after Thanksgiving marks Giving Tuesday, a day that celebrates the generosity of others by inspiring millions of people around the globe to give, collaborate and celebrate the power of giving.

And this year, with a little planning, you can maximize the impact of your gift. When you understand the tax strategies related to charitable contributions, you can determine what type of asset to give as well as when and how much to give to charity to receive the maximum tax advantages.

Most people already know that charitable donations can be deducted from their income taxes, but few may be applying a tax strategy to their giving. Check out some of these tips that can help you optimize your charitable giving to maximize your tax savings:

Long-term appreciated assets—If you donate long-term appreciated assets like bonds, stocks or real estate to charity, you generally don’t have to pay capital gains, and you can take an income tax deduction for the full fair-market value. It can be up to 30 percent of your adjusted gross income.

Combine multi-year deductions into one year – Many taxpayers won’t qualify for the necessary deductions to surpass the standard deduction threshold established by tax reform in 2017. However, you can still receive a tax benefit by “bunching” multiple years’ worth of charitable giving in one year to surpass the itemization threshold. In off-years, you take the standard deduction.

Estate Planning – By naming your specific charity in your will or as a beneficiary of a qualified insurance policy, retirement plan or trust, you reduce or even eliminate the burden of estate tax for your heirs. It is important to consult your tax and estate planning advisors regarding modifications to your estate plans.

Donor-advised fund – A donor-advised fund is a dedicated account for charitable giving. When you contribute to a charity that sponsors a donor-advised fund program, you are eligible for an immediate tax deduction. You can then recommend grants over time to any IRS-qualified public charity and invest the funds for tax-free growth. Donor-advised funds provide many benefits for organizing and planning giving, but they also offer advantages in terms of income, capital gains and estate taxes. In some cases, these benefits are more advantageous than those from contributing to a private foundation.

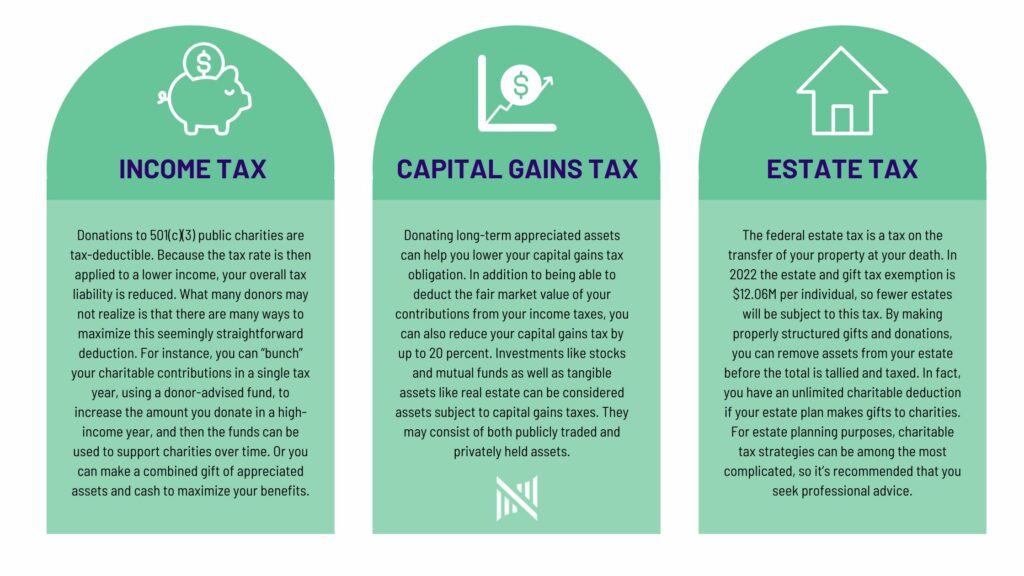

How you can defer or reduce taxes through charitable giving

By using the proper tax planning strategies, charitable contributions can reduce three kinds of federal taxes: income, capital gains and estate taxes. Team NextGen is here for you – call or click to discuss your options with a tax professional.